Using Forex Line Chart Trading

Line chart trading youtube.

However, a line chart should not be used by itself, as it does not provide enough price information and other complementing oscillators must be added. also, trading strategies are very hard to be backtested by using a simple line chart. line chart trading strategy support and resistance 1-min scalping. In this video you’ll discover: • what are line charts and how line charts work in forex and stock market • how to trade and how to read line charts (how to buy and sell using line charts). But it wasn’t like that back when technical analysis started. bar and line charts, for instance, dominated the industry, as professionals and retail traders alike used them. how to trade with line charts. despite everyone using japanese candlesticks techniques applied on candlestick charts, the simplest kind of charts contain only a single line.

Meet The New Baseline Chart Style Tradingview Blog

Forex line charts liteforex.

A Trading Strategy That Works Every Single Time

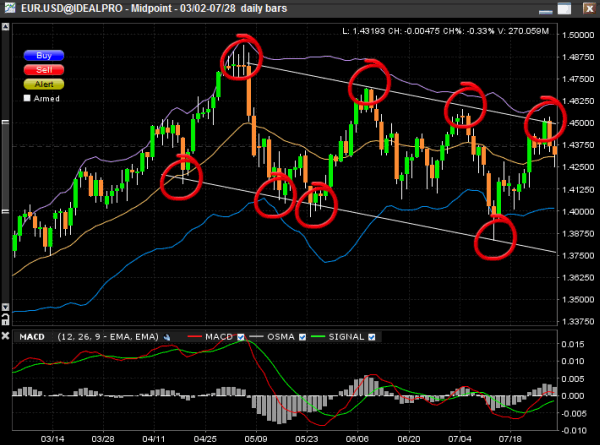

Therefore, instead of using candlestick charts, savvy traders use line charts and consider a relevant test only when the line chart touches the moving average. here’s the audusd chart. it shows a death cross (ma50 moving below ma200) and the price testing the ma50. In the weekly chart, the uptrend line in eur/aud chart is intact. so, i am expecting a rapid rise in eur/aud very soon. since the analysis is based on the weekly chart, using forex line chart trading we need to manage our entries carefully. i am looking to put buy trades between 1. 61 to 1. 63 with first target at 1. 70 and sl below the uptrend line.

Consider for example the following chart. on the left side, we use a line chart and on the right side, we’re using a candlestick chart: if we were to just set our stop loss levels using the line chart, we might have risked placing them too close to our entry. instead, it would be better to place them above the wicks of the candles. In order to study how the price of a currency pair moves, you need some sort of way to look at its historical and current price behavior.. a chart, or more specifically, a price chart, happens to be the first tool that every trader using technical analyst needs to learn. a chart is simply a visual representation of a currency pair’s price over a set period of time. Trading line charts interpretation. the interpretation of line charts is simple. they are basically price charts that connect the closing prices of a given market over a span of time. as the line charts only show closing prices, they offer a great value to traders by reducing noise.. this chart is also good for visualization of the overall trend of a security/ stock. Forex is a portmanteau of foreign using forex line chart trading currency and exchange. foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or.

Line chart is the easiest chart at forex. it using forex line chart trading represents a curve, which shows closing price for a certain period of time. line charts can be also based on the median price, opening price, lows or highs. a line chart is the first thing, which beginners learn in the financial market. The chief benefit of a line chart is its simplicity. a line chart offers a visually easy way to grasp changes in numerical value over time. below is a line chart of the eur/usd using the daily close for each data point. without adding any other indicator, your eye immediately sees a broad uptrend. line chart example for daily eur/usd rate as of.

Forexline Charts Liteforex

Line chart. a simple line chart draws a line from one closing price to the next closing price. when strung together with a line, we can see the general price movement of a currency pair over a period of time. it’s simple to follow, but the line chart may not provide the trader with much detail about price behavior within the period. It’s weird how clearly chart formations, patterns, highs and lows, and even the direction of a chart, can be much easier read on a line chart at least for me. since then, i always have a line chart open whenever i trade candlestick charts, and i have even developed a strategy based solely on line charts, which is performing nicely for me. The chart properties dialog lets you finetune extended settings: price source the time bar values that are displayed on the chart. the following options are possible: close, open, high, low, (high+low)/2, (high+low+close)/3, (open+high+low+close)/4. line up color and thickness of the line that displays the upper border. When trading this system, you will want to start out with clean line charts. the reason we use line charts and not candlestick charts is very simple: it allows us to focus on the things that matter. we want to see the patterns as clearly as possible.

I came across a few articles, and even bought a forex trading course on the topic. i personally find the widely-available advice on drawing the right zones to be very subjective. it doesn't lead anywhere. i first read about using a line chart to draw the proper zones. that helped a little: a powerful way to draw support and resistance zones. Spotting chart patterns is a popular hobby amongst traders of all skill levels, and one of the easiest patterns to spot is a triangle pattern. however, there is more than one kind of triangle to find, and there are a couple of ways to trade them. here are some of the more basic methods to both finding and trading these patterns. Apr 30, 2017 · chart patterns & trend action for forex, cfd and stock trading duration: 38:05. barry norman's investors education webinars 426,010 views.

You can place an order in several ways through the trading panel, the chart context menu, the chart “+” sign menu, or through the floating buy/sell panel. once the order ticket is opened you can set the “price”, “stop loss” and “take profit” values using either pips using forex line chart trading or prices. More trading forex using line chart images. Live bitcoin trading with crypto trading robot deribot on deribit deribot backup 916 watching live now use line charts to help identify supply and demand areas duration: 12:58. All you need to trade is a horizontal line trading is simple. there is an entire industry built around making you think it is complicated. all you need is a horizontal line on your chart to be a profitable trader. i bet you doubt me, don't you? go long when the price moves up to a price ends in 00, 25, 50 or 75.

What are supply and demand zones. so, what exactly is a supply zone and a demand zone. this would be best described by a chart: in the image above you see the german stock market dax. the red zone is marked as a supply zone. this could also be defined as an active resistance level or a place where traders are selling huge amounts. Tradinglinecharts interpretation. the interpretation of line charts is simple. they are basically price charts that connect the closing prices of a given market over a span of time. as the line charts only show closing prices, they offer a great value to traders by reducing noise.. this chart is also good for visualization of the overall trend of a security/ stock. Linechart is the easiest chart at forex. it represents a curve, which shows closing price for a certain period of time. line charts can be also based on the median price, opening price, lows or highs. a line chart is the first thing, which beginners learn in the financial market.

Comments

Post a Comment